Sterling Bank has established itself as a leader in the financial services sector by offering innovative solutions designed to meet the evolving needs of its customers.

Among these solutions is its robust internet banking platform, which has transformed the way individuals and businesses manage their finances.

Sterling Bank Internet Banking provides a seamless, secure, and convenient online experience, enabling customers to conduct a wide range of banking activities from the comfort of their homes or offices.

This service is part of the bank’s commitment to leveraging technology to enhance customer satisfaction and service delivery.

By offering an intuitive and user-friendly interface, Sterling Bank Internet Banking empowers customers to perform various transactions such as money transfers, bill payments, and account management efficiently.

Read: How to register for Stanbic IBTC bank internet banking and mobile app

Features And Benefits Of Sterling Bank Internet Banking

Sterling Bank’s internet banking platform is designed to make financial management seamless, secure, and accessible anytime, anywhere. Here’s a breakdown of its standout features and benefits:

- View balances, transaction history, and download statements with ease.

- Instantly transfer money between Sterling accounts or to other Nigerian banks via NEFT and NIP systems.

- Pay utility bills, cable subscriptions, and other services directly from your account.

- Recharge your phone or buy data bundles for all major networks.

- Block/unblock debit cards, set spending limits, and manage card preferences.

- Request cheque books, account statements, or update personal info online.

- Set up real-time alerts for account activity to stay informed and secure.

- Apply for loans, check loan status, and deposit cheques digitally

Benefits You’ll Enjoy

- Manage your finances anytime—even on weekends and holidays.

- Skip the queues and bank from your home, office, or on the go.

- Transactions are processed quickly, saving you time and hassle.

- Multi-layered protection ensures your data and transactions are safe.

- Ideal for SMEs and corporate users needing fast, reliable banking solutions

Read: How to register for polaris bank internet banking and Vulte mobile app

How To Register For Sterling Bank Internet Banking

Registering for Sterling Bank’s internet banking is a breeze, and you can do it all from the comfort of your home. Here’s a step-by-step guide to get you started:

- Go to the Sterling Bank Internet Banking site.

- On the homepage, select the Sign Up option for new users.

- Provide your Sterling Bank account number and registered phone number, then submit.

- You’ll receive a confirmation SMS with a code or instructions to proceed.

- Complete the registration by following the on-screen steps. You may be asked to create a username, password, and set up security questions.

- For added security, you can request a Sterling Secure Token from any branch. This generates a unique code for each transaction and helps protect your account.

Read; How to register for keystone internet banking and mobile app

Sterling bank mobile app

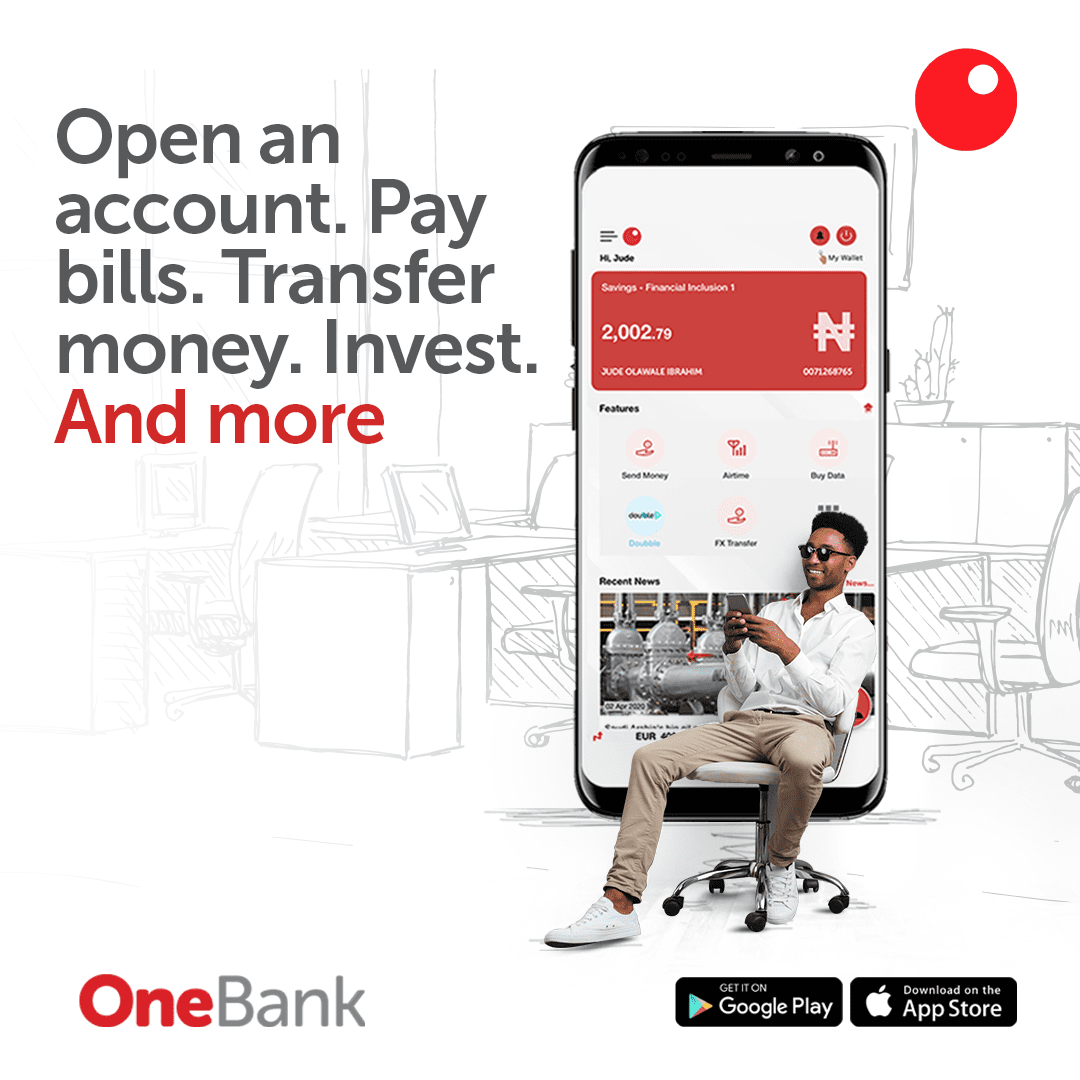

Sterling Bank’s primary mobile banking application is called OneBank. It’s a fully digital banking app that provides a range of financial services to customers in Nigeria. The app is available for download on both the Google Play Store and the Apple App Store.

Whether you’re sending money, paying bills, or managing your budget, OneBank puts it all at your fingertips.

Features

- No paperwork, no branch visits—open an account in minutes.

- Send money to any bank in Nigeria with zero transfer fees.

- Track spending, set goals, and manage your finances

- Pay for electricity, cable TV, internet, and recharge your phone effortlessly.

- Convert currencies and send money abroad with ease.

- Request physical or virtual debit cards, freeze/unfreeze cards, and even withdraw cash cardlessly.

- Get up to ₦1 million in overdraft—no forms, no delays.

- Request money from friends or clients using simple, shareable links.

- Chat with customer care and resolve issues without leaving the app

How to register for oneBank app

Registering for the OneBank app is a straightforward process that you can complete directly from your mobile device. The app offers two primary registration paths: one for new customers and one for existing Sterling Bank account holders. no need to visit a branch. Here’s how to get started:

- Search for “Sterling OneBank” on the Google Play Store (for Android) or the Apple App Store (for iPhone) and download the app.

- Launch the app and select the “Sign Up” option.

- Provide your mobile number, BVN, and email address

- If you already have a Sterling Bank account, you can link it directly

- You’ll receive an OTP (One-Time Password) via SMS

- Enter it to confirm your phone number

- Choose a username, password, and set up security questions

- You can also enable fingerprint or Face ID for easier access

- Once registered, you can begin using features like free transfers, bill payments, FX swaps, and more

Read: How to register for Gtbank internet banking and mobile app

How to transfer money from sterling bank

Sterling Bank Nigeria offers several convenient ways to transfer money—whether you’re sending funds to another Sterling account or to a different bank entirely. Here’s a full rundown of your options:

1. Using the OneBank Mobile App

This is the fastest and most flexible method for smartphone users.

- Open the OneBank app and log in

- Tap “Transfers”

- Choose Sterling to Sterling or Sterling to Other Banks

- Enter recipient details, amount, and a short description

- Confirm with your PIN or biometric authentication

Ideal for desktop users or businesses.

Steps:

- Log in at sterling bank online bsnking

- Navigate to Transfers

- Choose your transfer type and input details

- Authenticate with your token or password

How to buy airtime and data from sterlin bank

Buying airtime and data from Sterling Bank is super easy—whether you’re online or offline. Here’s how you can do it:

Option 1: Using the OneBank Mobile App

If you have the OneBank app, you can recharge in seconds.

Steps:

- Open the app and log in

- Tap “Airtime & Data”

- Choose your network provider (MTN, Airtel, Glo, 9Mobile)

- Enter the phone number and amount

- Confirm with your PIN or biometric login

Option 2: Using USSD Code (822#)

No internet? No problem.

To recharge your own line:

Dial *822*Amount#

Example: *822*500# to buy ₦500 airtime

To recharge another number:

Dial *822*Amount*RecipientNumber#

Example: *822*500*08012345678#

To buy data:

Use the OneBank app or dial *822# and follow the prompts for data purchase.

Note: You must dial from the phone number linked to your Sterling Bank account

How to pay bills from sterling bank

Paying bills with Sterling Bank—whether through the OneBank mobile app or SterlingPro internet banking—is designed to be fast, secure, and stress-free. Here’s how you can do it:

Paying Bills via OneBank Mobile AppSteps:

- Log in to the OneBank app

- Tap “Payments” or “Pay Bills”

- Select the bill category (e.g., electricity, cable TV, internet, water)

- Choose your service provider (e.g., PHCN, DSTV, Airtel, etc.)

- Enter your customer/account number and the amount

- Review the details and confirm with your PIN or biometric login

Supported Bills:

- Electricity (PHCN, IKEDC, EEDC, etc.)

- Cable TV (DSTV, GOTV, Startimes)

- Internet services

- Water bills

- Government levies and taxes

Paying Bills via SterlingPro Internet BankingSteps:

- Visit SterlingPro Internet Banking and log in

- Navigate to “Payments” or “Bill Payments”

- Select the type of bill and your service provider

- Input your customer details and amount

- Authenticate the transaction using your token or password

- Submit and receive confirmation instantly